Apartment Real Estate Investment Trusts

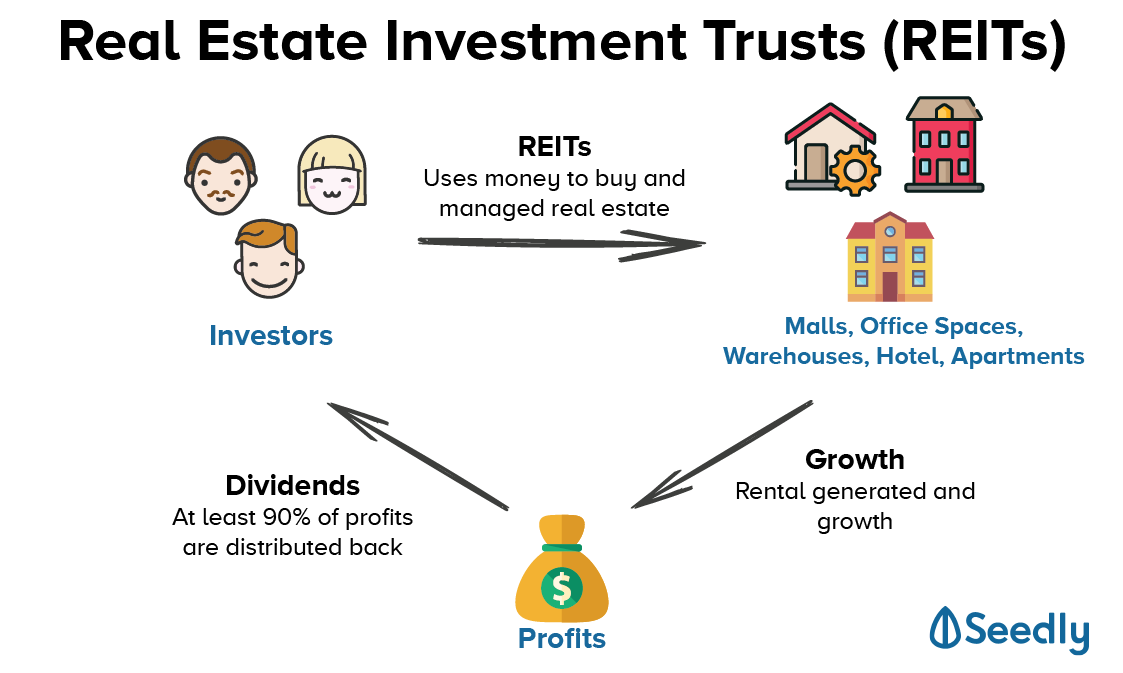

The reits units trade on the toronto stock exchange tsx under the symbol miunca. Real estate investment trusts reits invest in all types of properties from commercial offices to malls to hospitals.

apartment real estate investment trusts

apartment real estate investment trusts is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in apartment real estate investment trusts content depends on the source site. We hope you do not use it for commercial purposes.

What is a real estate investment trust.

Apartment real estate investment trusts. Reits own many types of commercial real estate ranging from office and apartment buildings to warehouses hospitals shopping centers hotels and timberlands. Real estate and capital markets. A real estate investment trust reit is a company owning and typically operating real estate which generates income.

Minto apartment reit is a real estate investment trust that owns and operates a portfolio of 29 high quality multi residential rental properties in toronto ottawa montreal calgary and edmonton. Reits provide all investors the chance to own valuable real estate present the opportunity to access dividend based income and total returns and help communities grow thrive and revitalize. A real estate investment trust reit is a company that owns operates or finances income producing real estate.

The fund is operated and owned by a company of shareholders who contribute money to invest in commercial properties such as office and apartment buildings. Real estate investment trusts reits allow individuals to invest in large scale income producing real estate. Most reits specialize in a specific real estate sector focusing their time.

Investment property partners property investors guide to uk real estate investment trusts reits includes a number of important factors that you may wish to consider if you are reviewing indirect property investment opportunities and more specifically uk reits. Some reits engage in financing real estate. A reit is a company that owns and typically operates income producing real estate or related assets.

Nareits members are reits and other businesses throughout the world that own operate and finance income producing real estate as well as those firms and individuals who advise study and service those businesses. One potentially lucrative category for reits is rental apartment complexes. It is canadas only 100 urban residential reit.

These may include office buildings shopping malls apartments hotels. Nareit is the worldwide representative voice for reits and publicly traded real estate companies with an interest in us. A real estate investment trust reit is a company that owns and in most cases operates income producing real estate.

A real estate investment trust reit is an investment fund or security that engages in income generating real estate properties. Real estate investment trusts offer the primary benefits of real estate investing diversification dividend income and an inflationary hedge without the responsibilities of owning and.

Best Reits To Capture In The West Western Investor

Best Reits To Capture In The West Western Investor

Working Adults Guide To Reits Investing In Singapore

Working Adults Guide To Reits Investing In Singapore

Minto Apartment Reit Closes The Purchase Of Rockhill

Minto Apartment Reit Closes The Purchase Of Rockhill

Understanding Reits Diversyfund

Understanding Reits Diversyfund

Nvu Un Stock Price Forecast News Northview Apartment Reit

Nvu Un Stock Price Forecast News Northview Apartment Reit

Residential Reits Reit Institute

Residential Reits Reit Institute

Reit Beginner S Guide What You Need To Know To Get Started

Reit Beginner S Guide What You Need To Know To Get Started

What Are Real Estate Investment Trust Invest Travel Play

What Are Real Estate Investment Trust Invest Travel Play

Residential Real Estate Investment Trusts In Africa Cahf

Blackstone Is Taking Over Mom And Pop Real Estate Investing Wsj

Blackstone Is Taking Over Mom And Pop Real Estate Investing Wsj