Calculating Capital Gains Tax On Sale Of Second Home

Capital gains tax cgt becomes payable when you sell an asset such as a business a second property shares or an heirloom and make money from the sale. The amount you pay depends on your income and the asset.

How To Save Capital Gains Tax On Sale Of Plot Flat House

calculating capital gains tax on sale of second home is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image wallpaper for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark calculating capital gains tax on sale of second home using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Dear mokbul the irs allows you to exclude all or some of the gain on the sale of your home if you meet the requirements.

Calculating capital gains tax on sale of second home. Your gain is usually the difference between what you paid for your property and the amount you got when you sold or disposed of it. Capital gains are the difference between the purchase price of your real estate and the price you sell it for. The irs will assess a capital gains tax when you sell a second home for a profit.

There are short term capital gains and long term capital gains and each is taxed at different rates. Following reductions in rates announced in budget 2016 basic rate income taxpayers are. Youll need to work out your gain to find out whether you need to pay capital gains tax.

While the tax cuts and jobs act bill passed in late 2017 did not change how capital gains on a vacation home are calculated it did change the tax brackets. Capital gains tax apply to certain types of sale usually income properties and refers to what you pay on that difference after adjusting for a variety of exemptions deductions and tax breaks. However you might have to share the proceeds from selling your home with uncle sam.

When you sell your home the internal revenue service isnt likely to be high on your list of things to worry about. You can usually sell your primary home without worrying about taxes but different rules apply to vacation homes and. The irs taxes capital gains at the federal level and some states also tax capital gains at the state level.

Knowing the formula for calculating your capital gain on the sale as well as the primary residence exclusion helps. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling. For the sale of a second home that youve owned for at least a year the capital gains tax rates for 2019 are 0 percent 15 percent or 20 percent depending on your income in that year including the gain on the sale of the property.

For most people the capital gains tax rate for a second home is 15 percent although it all depends on your tax bracket. Theyre generally only deductible on investments like securities and investment properties not ones you live in part of the year. Capital gains on the sale of a second home can be offset by other capital losses.

If so how much might that be. Now if i sell my maryland home for 370000 will i have to pay capital gains tax. When it comes to capital gains taxes the internal revenue service draws a hard line between homes used as principal residences and investment properties.

However the rules for the capital gains tax exclusion on a second home sale are tricky. A second home and capital gain tax rules. What is the capital gains tax rate on real estate.

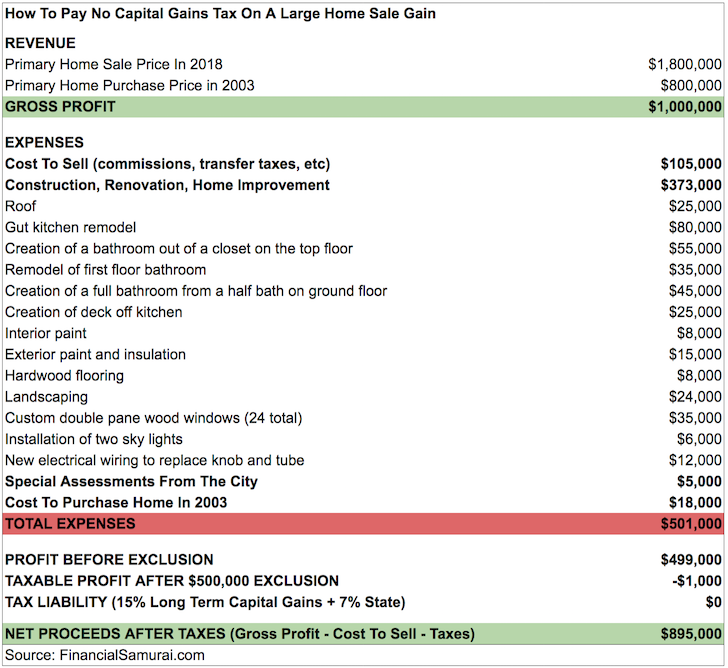

How To Pay No Capital Gains Tax After Selling Your House For

How To Pay No Capital Gains Tax After Selling Your House For

How To Save Capital Gains Tax On Sale Of Plot Flat House

How To Save Capital Gains Tax On Sale Of Plot Flat House

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png) The Home Sales Exclusion From Capital Gains Tax

The Home Sales Exclusion From Capital Gains Tax

How Could Capital Gains Tax Affect The Selling Of My Second

How Could Capital Gains Tax Affect The Selling Of My Second

How To Avoid Capital Gains Taxes When Selling Your House

How To Avoid Capital Gains Taxes When Selling Your House

How To Save Capital Gains Tax On Sale Of Plot Flat House

How To Save Capital Gains Tax On Sale Of Plot Flat House

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains On Sale Of Gifted Property

How To Calculate Capital Gains On Sale Of Gifted Property

Capital Gains Tax Calculator Real Estate 1031 Exchange

Capital Gains Tax Calculator Real Estate 1031 Exchange

3 Ways To Avoid Capital Gains Tax On Second Homes Wikihow

3 Ways To Avoid Capital Gains Tax On Second Homes Wikihow