Are Real Estate Taxes On A Second Home Deductible

However you must factor in any rental days to arrive at a ratio of time personally spent in the house. Mortgage interest paid on a second residence is also deductible as long as you dont rent out the residence during the tax year and the mortgage satisfies the same requirements for deductible interest as on a primary residence.

Buying A Second Home Tax Tips For Homeowners Turbotax Tax

Buying A Second Home Tax Tips For Homeowners Turbotax Tax

are real estate taxes on a second home deductible is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image wallpaper for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark are real estate taxes on a second home deductible using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

When its time to file your income tax return you can itemize and deduct real estate property taxes from both your primary residence and your second home and on any additional homes you own but keep in mind that the new tax cuts and jobs act of 2017 caps this deduction at 10000.

Are real estate taxes on a second home deductible. If you use the property as a second homenot as a rentalyou can deduct mortgage interest just as you would for a second home in the us. 100000 if married filing jointly. One of the benefits of home ownership is the real estate tax deduction most homeowners are allowed to take.

50000 if filing single. For 2019 you can deduct the interest you pay on the first 750000 375000 if married filing separately of qualified mortgage debt on your first and second homes thats the total amount. For example the internal revenue service allows deductions for real estate taxes on any home or other real property you own.

Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property tax year that each owned the home. Tax rules affecting the ownership of second homes will look different in 2018. The property tax writeoff you get if you own a second home is the same as you get with taxes on your principal residence.

In other words you can deduct real estate taxes youve paid on first and second. Pay attention to the new 750000 limit for the mortgage interest deduction as well as the 10000 cap on property state and local income taxes. You might refinance or sell the home before you pay off the mortgage.

State and local real property taxes are generally deductible. See the earlier discussion of real estate taxes paid at settlement or closing under state and local real estate taxes earlier to figure the real estate taxes you paid or are considered to have paid. Many people who buy a second home may already exceed that limit with their first home and so may enjoy no additional tax savings for their second home.

If you itemize deductions you can deduct real estate taxes and points you pay over the life of a mortgage to buy a second home. Home prices in certain markets may be more susceptible to change than. Real estate taxes also called property taxes for your main home vacation home or land are an allowable deduction if they are based on the assessed value of the property and the property is for your own personal use.

Now the total of all state and local taxes eligible for a deduction including property and income taxes is limited to 10000 per tax return or 5000 if youre married and filing separately. The home equity debt on your main home and second home is more than. Use that percentage to determine just how much you can deduct.

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png) How The Mortgage Interest Tax Deduction Works

How The Mortgage Interest Tax Deduction Works

Deduct Mortgage Interest On Second Home

Deduct Mortgage Interest On Second Home

Can I Deduct The Real Estate Taxes On A Second Home Home

Can I Deduct The Real Estate Taxes On A Second Home Home

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Deductions For Home Mortgage Interest Under Tcja

Publication 936 2018 Home Mortgage Interest Deduction

Publication 936 2018 Home Mortgage Interest Deduction

Tax Breaks For Second Home Owners

Tax Breaks For Second Home Owners

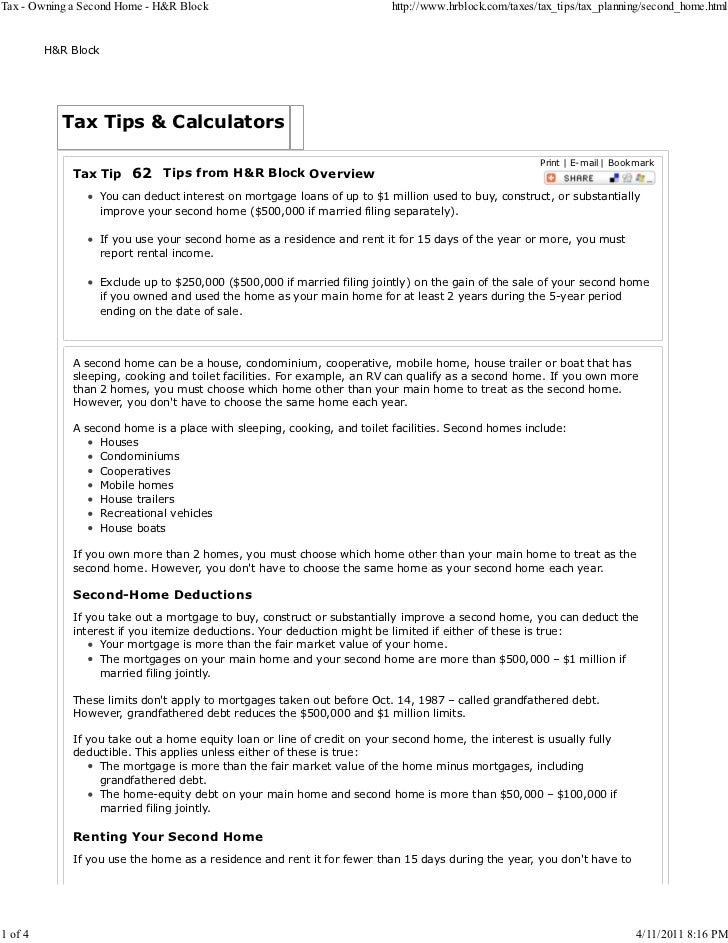

Tax Owning A Second Home H R Block

Tax Owning A Second Home H R Block

Tax Owning A Second Home H R Block

Tax Owning A Second Home H R Block

How To File A Deduction For A Second Home For Work In Mytax

How To File A Deduction For A Second Home For Work In Mytax

Real Estate Agents What Auto Use Is Deductible A Lot More

Real Estate Agents What Auto Use Is Deductible A Lot More

How To Avoid Capital Gains Taxes When Selling Your House

How To Avoid Capital Gains Taxes When Selling Your House