Do You Get Money Back If You Refinance Your Home

How to refinance and get money back. When you refinance a mortgage the existing escrow account is usually closed and a new one opened specific to the new loan.

Should I Refinance My Home Peglar Real Estate Group

Should I Refinance My Home Peglar Real Estate Group

do you get money back if you refinance your home is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image wallpaper for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark do you get money back if you refinance your home using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Ask your previous lender for a time frame.

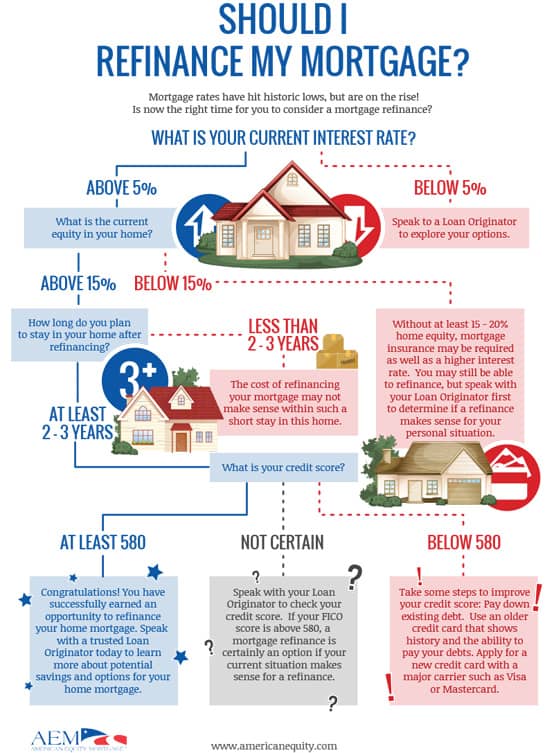

Do you get money back if you refinance your home. However that doesnt. Streamline your fha mortgage this specific type of loan can be extremely beneficial to the homeowner looking to refinance. Consider how long youll be paying down the rest of the mortgage so you dont lose your potential savings to additional interest costs.

Home is where the equity is an article on the importance and process of building equity. Less certain is the exact turnaround time of a refund check. Refinancing your mortgage can be a great decision given the right set of circumstances.

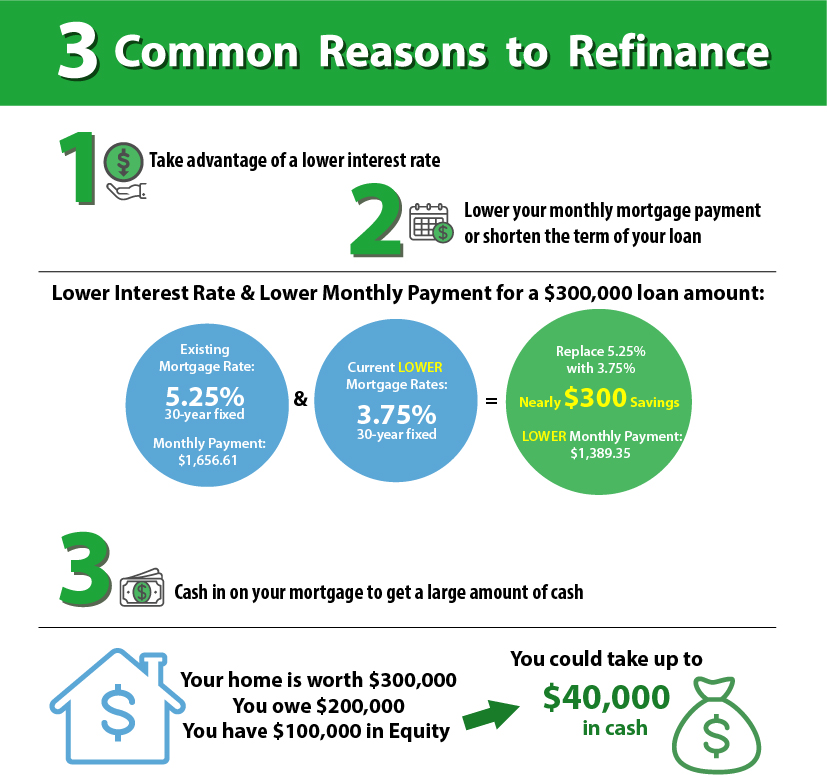

One of the benefits to refinancing your home loan is that it allows you to convert some of your home equity into. Financial institutions may lend you up to 80 percent of the appraised value of your home without additional fees for mortgage insurance. Determine which loan type fits your situation the best.

Take a look and know your rights. Second mortgages can be fixed rate and term loans or can be home equity lines of credit helocs where you have access to the equity loan with credit cards and checks. To qualify for a cash out refinance you need to have a certain amount of home equity.

All mortgages require a monthly payment. Cash out refinancing and home equity. You can use the equity in your home to consolidate other debt or to fund other expenses.

Thats what youre borrowing against. Home affordable refinance program new programs are available to help you refinance. A cash out refinance replaces your current mortgage for more than you currently owe but you get the difference in cash to use as you need.

You can borrow the money you need as with a home equity loan or line of credit heloc. If you have equity in your home you may be able to refinance and get money back to make repairs pay for college consolidate bills or take dream vacation. It should quote 30 days or less due to federal mortgage closing regulations.

Using your homes equity to finance a luxury vacation may seem like a good idea but you may be surprised when tax season rolls around. If you want to avoid extra taxes when you refinance and take cash out of your home it pays to understand irs restrictions on how you spend the money. Lets say your home is worth 250000 and you owe 150000 on your mortgage.

With a standard first mortgage the monthly payment consists of the principal repayment prorated property tax prorated homeowners. Your former lender likely owes you money if you had an escrow account before you refinanced your mortgage. If you are five years into a 30 year mortgage and you refinance into another 30 year mortgage you are going back to the beginning and may pay more in total interest baker says.

When Should You Refinance Your Home Loan Nuhome Team

Why Should I Refinance My Home Lowermybills Com

Why Should I Refinance My Home Lowermybills Com

4 More Questions To Ask Before Refinancing Your Home

4 More Questions To Ask Before Refinancing Your Home

How Refinancing Works When To Refinance Your Home Pennymac

How And Why You Get Your Money Back When Refinancing

How And Why You Get Your Money Back When Refinancing

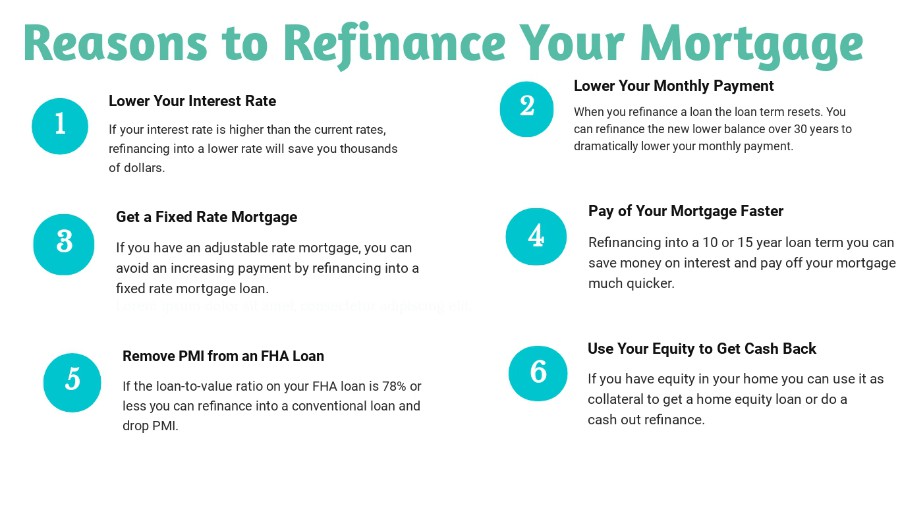

Top Reasons To Refinance Your Home Loan

Top Reasons To Refinance Your Home Loan

5 Ways To Know When To Refinance Your House Badcredit Org

5 Ways To Know When To Refinance Your House Badcredit Org

How And Why You Get Your Money Back When Refinancing

How And Why You Get Your Money Back When Refinancing

When Is The Right Time To Refinance Your Mortgage Loanry

When Is The Right Time To Refinance Your Mortgage Loanry