Irs Rules On Selling A Home And Tax Implications

This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. Profit on home sale usually tax free.

How To Avoid Capital Gains Taxes When Selling Your House

How To Avoid Capital Gains Taxes When Selling Your House

irs rules on selling a home and tax implications is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image wallpaper for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark irs rules on selling a home and tax implications using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Researching your tax obligations when selling your rental property involves becoming aware of the law.

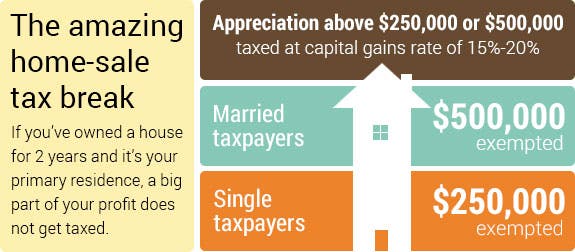

Irs rules on selling a home and tax implications. Publication 523 selling your home provides rules and worksheets. Do i have to pay taxes on the profit i made selling my home. The exclusion is increased to 500000 for a married couple filing jointly.

409 covers general capital gain and loss information. Discounted prices could land you with a bill for gift tax. But if youre giving something to your family that you wouldnt give to a stranger you may be in for extra scrutiny.

Property depreciates and the irs realizes this so they have rules in place. Most home sellers dont even have to report the transaction to the irs. Since tax laws are complicated and change periodically its advisable to consult with a qualified real estate tax specialist who.

This article will address some of the most common topics. The internal revenue service doesnt care who you sell your house to and all transactions get the same tax treatment. For a married couple filing jointly with a taxable income of 480000 and capital gains of 100000 for example taxes on those rental property gains would amount to 20000.

But if youre one of the exceptions knowing the rules will help you hold down your tax bill. But because owning any home carries a significant financial burden from mortgage and taxes to maintenance and repairs its in your best interest to learn the tax implications for you of second home ownership. Selling rental property could result in a significant tax bite depending on the profit you realize from the sale.

If you meet certain conditions you may exclude the first 250000 of gain from the sale of your home from your income and avoid paying taxes on it. If you have a capital gain from the sale of your main home you may qualify to exclude up to 250000 of that gain from your income or up to 500000 of that gain if you file a joint return with your spouse. This includes knowing the tax consequences that effect tax implications when selling rental property.

Tax implications when selling rental property.

:max_bytes(150000):strip_icc()/will-i-pay-tax-on-my-home-sale-2389003-v4-5b4cb96046e0fb0037e65b73.png) Will I Pay Tax When I Sell My Home

Will I Pay Tax When I Sell My Home

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png) The Home Sales Exclusion From Capital Gains Tax

The Home Sales Exclusion From Capital Gains Tax

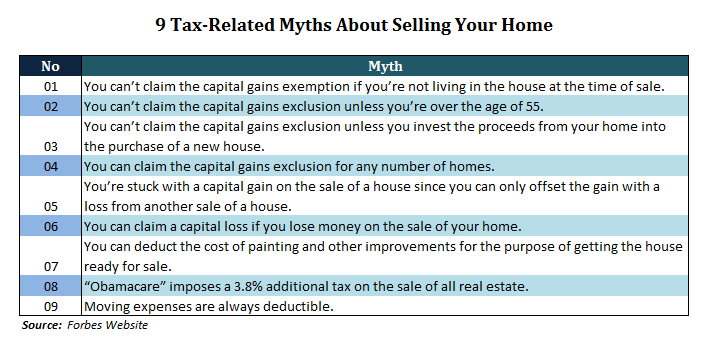

Irs Rules On Selling A Home And Tax Implications Tips

Irs Rules On Selling A Home And Tax Implications Tips

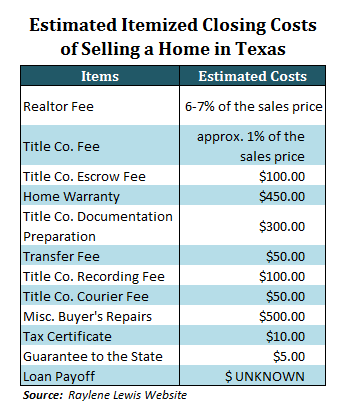

Tax Deductions When Selling A Home

Tax Deductions When Selling A Home

Tax Consequences For The Sale Of An Inherited Property

Tax Consequences For The Sale Of An Inherited Property

How To Avoid Capital Gains Taxes When Selling Your House

Tax Deductions When Selling A Home

Tax Deductions When Selling A Home

Capital Gains On Home Sale Due To Job Change

Capital Gains On Home Sale Due To Job Change

The Irs Code Section 1031 Like Kind Exchange A Tax Planning

The Irs Code Section 1031 Like Kind Exchange A Tax Planning

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

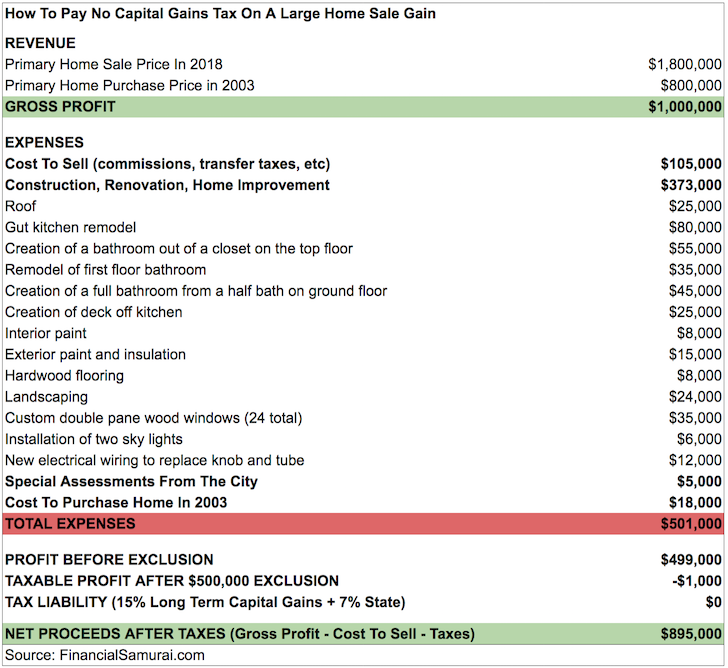

How To Pay No Capital Gains Tax After Selling Your House For

How To Pay No Capital Gains Tax After Selling Your House For