Bank Of Montreal Home Equity Line Of Credit Rates

If there is more than one co applicant please call us to proceed at 1 866 609 4722. Turn your homes market value into cash with a home equity loan.

Line Of Credit Loan Vs Line Of Credit Bmo

Line Of Credit Loan Vs Line Of Credit Bmo

bank of montreal home equity line of credit rates is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image wallpaper for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark bank of montreal home equity line of credit rates using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Home equity lines of credit are revolving credit.

Bank of montreal home equity line of credit rates. Home equity lines of credit are subject to standard credit approval. With our loan calculator and help me choose tool we can help you find the best way to borrow. Your home can be your most powerful financial borrowing tool.

Our mortgage add on feature is another way you can use your existing home equity to fund a renovation or other financial goals. This convenient mortgage option lets you access additional funds by simply. The bank of montreal offers competitive home equity products that span a wide range of values making them a good choice to look into for your home equity loan or home equity line of credit.

A statement is issued every 30 days. Home equity is the current market value of your home minus the remaining balance of your mortgage. Access ongoing secure credit against the equity of your home and withdraw funds whenever you need.

A td home equity line of credit heloc helps you borrow at a low intereste rate by using the equity youve built in your home. Get a personal loan or line of credit thats right for you. Also known as a second mortgage tap into 80 of your homes value to pay for larger purchases.

You can borrow money pay it back and borrow it again up to a maximum credit limit. If you are applying for a joint loan the co applicant must also complete the application. With a secured credit line we can offer you a lower interest rate than we could with a regular unsecured line of credit 1.

The lender uses your home as a guarantee that youll pay back the money you borrow. As long as the line of credit is in effect the borrower must draw the balance of the line of credit down by at least 10 at least twice a year at intervals of six months each. Subject to credit approval by national bank of canada.

With the rbc homeline plan you have access to our royal credit line and royal bank mortgages all in one plan which you can designate for different needs including home renovations a new car a vacation or your childs education. The mortgaged property for the home equity line of credit must be in canada. Home equity line of credit heloc a home equity line of credit heloc is a revolving line of credit that allows you to borrow the equity in your home at a much lower interest rate than a traditional line of credit.

A home equity line of credit heloc is a secured form of credit.

Faqs About The Bmo Homeowner Readiline Heloc Ratehub Ca Blog

Faqs About The Bmo Homeowner Readiline Heloc Ratehub Ca Blog

Home Equity Loans Second Mortgage Bmo

Home Equity Loans Second Mortgage Bmo

Canadian Defence Community Banking Bmo Bank Of Montreal

Canadian Defence Community Banking Bmo Bank Of Montreal

Heloc Introductory Interest Rates Heloc Offers Bmo Harris

Heloc Introductory Interest Rates Heloc Offers Bmo Harris

Bmo Home Equity Line Of Credit

Bmo Home Equity Line Of Credit

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/MLPAIRGK5JGN3D7L6F47SO5PFE.JPG)

Home Improvements With A Heloc Heloc Offers Bmo Harris Bank

Home Improvements With A Heloc Heloc Offers Bmo Harris Bank

Faqs About The Rbc Homeline Plan Home Equity Line Of Credit

Faqs About The Rbc Homeline Plan Home Equity Line Of Credit

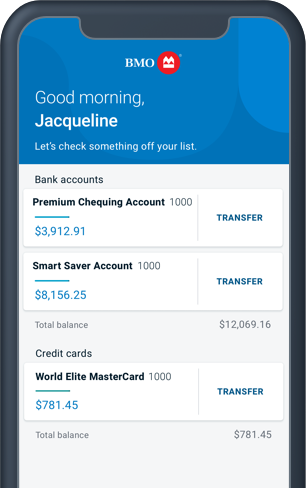

Online Access And Credit Card Features Online Banking Bmo

Online Access And Credit Card Features Online Banking Bmo