Can Capital Gain Be Used To Pay Home Loan

Can i pay my capital gain from this sale to repay my home loan without opening any capital gain account and just repay my loan from the money receipt to my bank for this sale. With the exception of the noted potential restrictions capital gains realized from selling real estate can be used for any purpose including to pay off a second mortgage.

Can You Take A Home Loan And Also Claim Ltcg Tax Exemption

Can You Take A Home Loan And Also Claim Ltcg Tax Exemption

can capital gain be used to pay home loan is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image wallpaper for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark can capital gain be used to pay home loan using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Capital losses can also be carried forward to be set off against future gains for up to eight assessment years.

Can capital gain be used to pay home loan. While the rates of both are the same the differences lies in the inflation indexation which is taken into consideration ie the inflation rate of the future based on. Capital gains are taxable under the income tax i t act. Also capital loss cannot be set off against any other form of income.

Will part pre payment of 30 lacs towards home loan be considered as reinvestment of capital gain under section 54. I used this ltcg of 30 lacs subsequently to do part payment of my home loan of 70 lac on 15th oct 2013. Taxes on property in our country are of two types short term and long term.

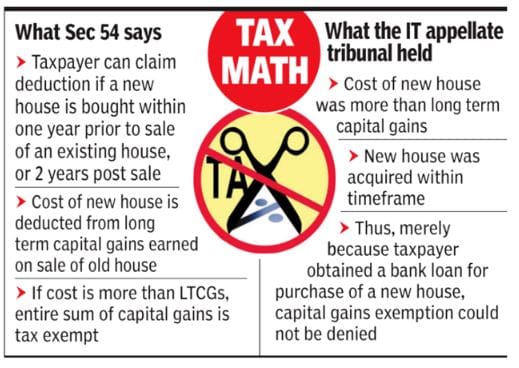

Latest itat tribunal court order. The short answer to your question is that the home equity line of credit is unrelated to the potential capital gain or loss on the sale of your home. One amit parekh had claimed exemption on capital gains tax of rs 59 lakh under section 54.

I t authorities however argued parekh was not eligible to claim the deduction since he took a home loan of rs 82 lakh from a private lender to make the purchase and only rs 937 lakh was used from the sale proceed to buy the new property. To calculate the gain or loss on the sale of your property you take the gross sales price less your selling expenses to calculate the total amount realized. Can capital gains on sale of house be used to repay home loan.

Our should i open a capital gain account and trafer my gains and then repay my loan. The only way you can access a capital gain to pay off a second mortgage is to sell the property on which you have the gain. Capital gains on sale of two or more properties.

Can i claim exemption us 54f for repayment of home loan. Can you take a home loan also claim ltcg tax exemption on sale of real estate property under section 54 54f. Using capital gains from real estate to retire a second mortgage.

What tax deductions can i get for repayment of home loan. I have a doubt because home loan could be interpreted as borrowed capital. You are entitled to two types of deductions for a home loan.

If on sale of a residential house held for at least two years the taxpayer makes a profit then such profit is treated as a long term capital gain. This gain is taxable at 20 with an adjustment for inflation referred to as indexation benefit. A capital gain is different from the paper profit that you earn when your propertys paper value goes up.

Capital gains refers to the profit that you earn when you sell your property.

Capital Gains Exemption Valid Even If Housing Loan Used For

Capital Gains Exemption Valid Even If Housing Loan Used For

Capital Gains Exemption Valid Even If Housing Loan Used For

Capital Gains Exemption Valid Even If Housing Loan Used For

Can I Claim Tax Exemption On Ltcg On Sale Of Property

Can I Claim Tax Exemption On Ltcg On Sale Of Property

Can You Take A Home Loan And Also Claim Ltcg Tax Exemption

Can You Take A Home Loan And Also Claim Ltcg Tax Exemption

Does The Capital Gains Exemption Apply Even When The Housing

Does The Capital Gains Exemption Apply Even When The Housing

Invest Capital Gains In Other Assets And Claim Exemption

Invest Capital Gains In Other Assets And Claim Exemption

Itat Rules Capital Gain Exemption Available Even If Housing

Itat Rules Capital Gain Exemption Available Even If Housing

Itr Filing How To Maximise Your Income Tax Refund

Itr Filing How To Maximise Your Income Tax Refund

Three Different Routes To Save Tax On Long Term Capital Gains

Three Different Routes To Save Tax On Long Term Capital Gains

Purchase House Property By Bank Loan Make Capital Gain

Purchase House Property By Bank Loan Make Capital Gain

Capital Gains Tax Brackets 2019 What They Are And Rates

Capital Gains Tax Brackets 2019 What They Are And Rates